Compound interest calculator with deductions

However the IRS limits your mortgage interest deduction to interest paid on up to 750000 375000 for married filing separate filers of debt incurred after Dec. T number of years.

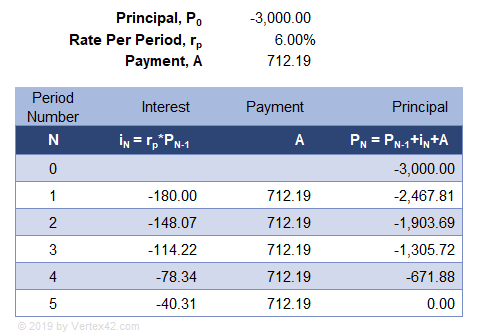

Use Excel To Create A Loan Amortization Schedule That Includes Optional Extra Payment Amortization Schedule Mortgage Amortization Calculator Schedule Templates

The ClearTax Simple Interest Calculator shows you the compound interest that you earn on investments.

. R Rate of Interest in decimals n number of compounding in a year. You can take a medical tax expense deduction only if your overall unreimbursed medical costs exceed 75 of your adjusted gross income AGI. So rate of interest of your housing loan changes in line with the Repo Rate.

ICICI Banks floating rate of interest is linked to Repo Rate declared by RBI from time to time. Simple Interest Calculator - Use ClearTax simple interest calculator to calculate simple interest. Alternative Minimum Tax AMT Strategies Internal Revenue Service.

Marriage has significant financial implications for the individuals involved including its impact on taxation. Online Compound Interest Calculator - Use ClearTax compound interest calculator to calculate compound interest earned daily weekly monthly quarterly annually. We will calculate the rate of interest applied to calculate the interest payment amount.

Simple and Compound Interest Calculator. All you need to provide is the expected future value FV the discount rate return rate per period and the number of periods over. Claim your deductions and get your acknowledgment number online.

Formula for Compound Interest. As per guidelines of RBI floating rate Home Loans from banks are linked to external benchmark rates. Compound Annual Growth Rate Calculator.

Get step-by-step instructions for calculating withholding and deductions from employee paychecks including federal income tax and FICA tax The Balance Small Business Menu Go. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States. To use the calculator for the previous rates please click here.

Interest on Home Equity Loans Often Still Deductible Under New Law Dance Bigelow Co PC. Acid Test Ratio Quick Ratio Calculator. Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts Best Personal Loans Best Car.

Both PPF and FD investments can be claimed for tax deductions. Claim your deductions and get your acknowledgment number online. Does PPF compound interest annually.

You can efile income tax return on your income from salary house property capital gains business profession. These are the deductions that will not be withheld by the employer but can be subtracted from taxable income including IRA contributions student loan interest qualified tuition and education-related fees up to 4000 etc. Publication 936 2019 Home Mortgage Interest Deduction Internal Revenue Service.

Who Can Deduct Mileage for Medical Reasons. What is Present Value. An online PPF interest calculator provides an investor with an estimation of how much interest can be earned given an amount of principal in hand.

Financial caution Using the PV calculator. This calculator uses the new IRD rates post March 31st 2021 and does include the new 39 personal tax rate on remaining income over 180000. Therefore the rate of interest per month will be 1339 365 31 which is 114 for the Oct billing period.

Present Value calculation example. 1339 is the annual rate and if we divide the same by 365 and multiply the same by the number of days in Oct which is 31. 2017 Deductions and Exemptions Single Married Filing Jointly Widower Married Filing Separately Head of Household.

Our Present Value calculator is a simple and easy to use tool to calculate the present worth of a future asset. P Principal amount. This marginal tax rate means that.

You can deduct your mileage at the standard rate of 18 cents per mile for 2022 and 16 cents per mile for 2021 or you can deduct your actual costs of gas and oil. The Home Mortgage Interest Deduction Internal Revenue Service. Now couples filing jointly may only deduct interest on up to 750000 of qualified home loans down from 1 million in 2017.

Pay As You Earn PAYE is a withholding income tax for employees in. Your average tax rate is 1198 and your marginal tax rate is 22. Using the PV calculator.

Under section 80C of the Income Tax Act investors can claim deduction up to INR 150000. For married taxpayers filing separate returns the cap is 375000. For example if a sum of Rs 10000 is invested for 3 years at 10 compound interest rate quarterly compounding then at the time of maturity A.

A floating rate of interest is linked to a benchmark rate. If you make 70000 a year living in the region of Colorado USA you will be taxed 11001. You can efile income tax return on your income from salary house.

A P 1rn n t Where A Maturity Amount. ROI Return on Investment Calculator.

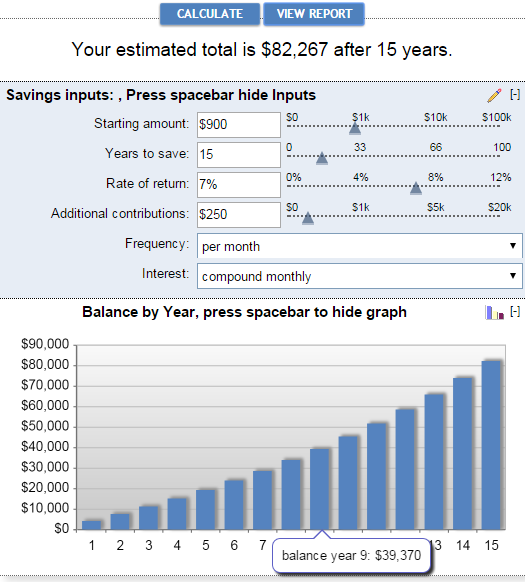

Compound Interest Calculator Daily Monthly Quarterly Annual

Pin On Excel Tips

37 Handy Business Budget Templates Excel Google Sheets ᐅ Inside Small Business Bud Excel Budget Template Business Budget Template Budget Template Excel Free

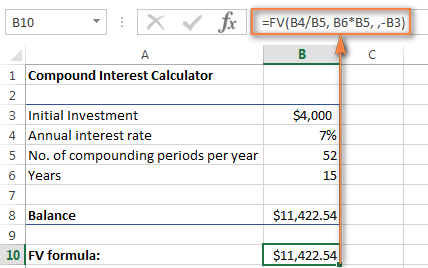

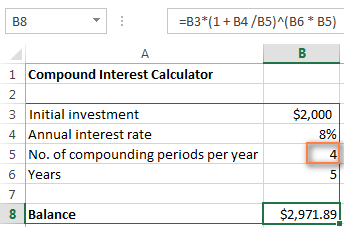

Compound Interest Formula And Calculator For Excel

Paypal Fees Calculator Know How Much You Ll Pay My Money Cottage Paypal Online Calculator Money Saving Advice

Pin On Accounting Blog

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Formula And Calculator For Excel

Compound Interest Calculator For Excel

Pin On Enquirygate

Compound Interest Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

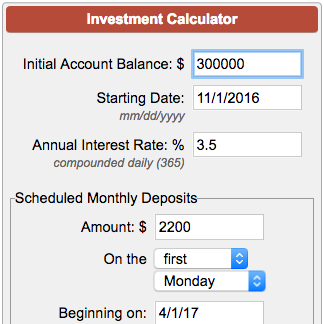

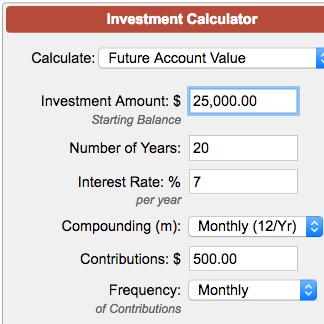

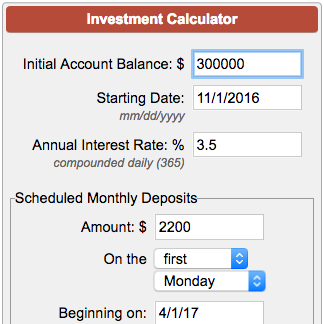

Investment Calculator

Compound Interest Calculator Daily Monthly Quarterly Annual

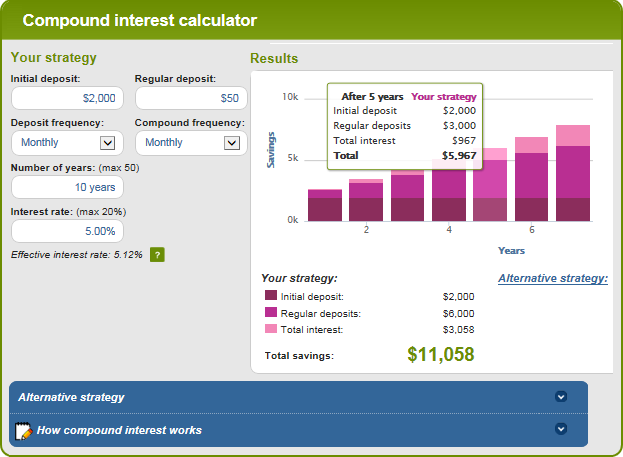

Compound Interest Calculator Investor Gov Interest Calculator Compound Interest Calculator

Investment Account Calculator